BRIGHT YOUR FINANCIAL JOURNEY

Take Control of Your Financial Future with Bright Financial

At Bright Financial, we’re committed to empowering you with flexible loan solutions that align with your financial goals. Whether you’re preparing for a big purchase, managing an unexpected expense, or looking to take better control of your budget, we’re here to help. With our seamless process and competitive rates, accessing the funds you need is fast and easy.

Customized Loan Solutions

Access personal loans from $1,000 to $50,000, designed to meet your financial needs.

Transparent Rates and Terms

Select from 3 or 5-year terms, with fixed rates starting as low as 6.99% APR.

Freedom to Repay Early

Pay off your loan ahead of schedule with no penalties or fees.

Take Charge of Your Financial Journey with Bright Financial

At Bright Financial, we’re dedicated to helping you achieve financial stability with flexible repayment options and industry-leading security. Experience a smooth, secure lending process tailored to support your financial future.

- Customized Repayment Plans

- Unmatched Data Protection

- Ongoing Financial Guidance

Why Choose Bright Financial?

At Bright Financial, we’re focused on empowering you to take charge of your financial future. We know that life is full of opportunities and challenges, and we’re here to guide you with confidence. Here’s why Bright Financial is your go-to partner for personal loans:

Tailored Loan Options

We offer personalized loan plans designed to align with your financial goals.

Effortless Application Process

Enjoy a quick and easy process with expert guidance at every step.

Putting Customers First

Your needs are our priority, with support that helps you make the right financial decisions.

Expert Support at Every Step

Our knowledgeable team is here to guide you throughout your financial journey.

Flexible Repayment Plans

Find a repayment schedule that works best for your budget and timeline.

100% Transparency

We value honesty—no hidden costs, no surprises, just clear and upfront terms.

Results You Can Trust

At Bright Financial, we’re committed to helping you reach your financial goals. Our dedication to excellence is evident in the success stories of our clients.

- Thousands of Happy Clients

- 95% Loan Approval Rate

- 98% Client Satisfaction and Recommendation Rate

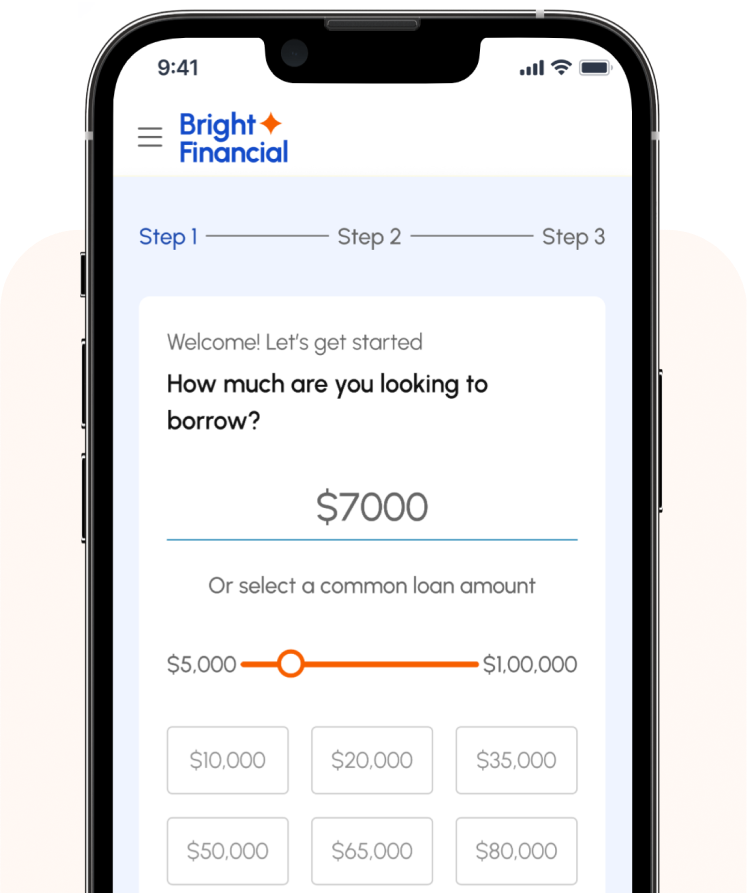

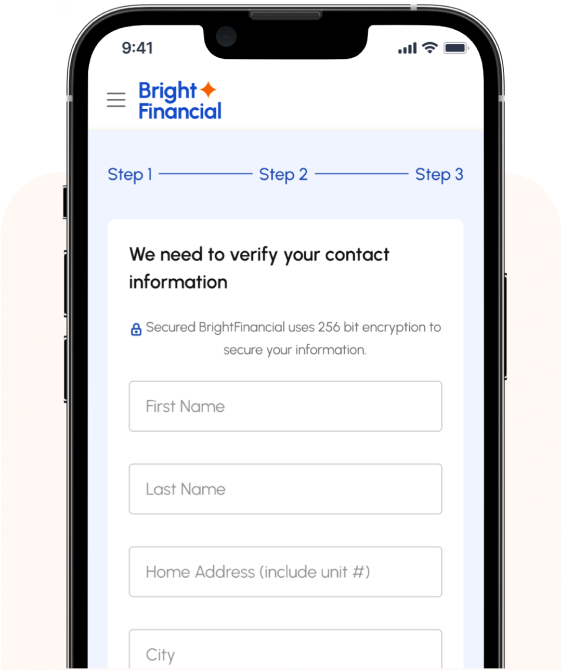

Secure Your Loan in Just Three Simple Steps

Submit Your Details

Fill out our easy online form and choose a time for one of our loan specialists to contact you. We’ll reach out at your convenience to get the process started.

Review Your Options

Connect with our loan experts to discuss your needs and find the best terms for your financial situation. If eligible, we’ll guide you through the next steps seamlessly.

Get Fast Approval

Experience quick approval with funds typically deposited into your account within one business day. Start your journey to financial freedom today!

Hear What Our Satisfied Clients Have to Say

I needed funds quickly, and Bright Financial made the entire process seamless. Their team was incredibly responsive, and the money was in my account the very next day. Couldn’t be happier!

Laura M.

Bright Financial was a lifesaver during a challenging time. The approval process was so fast, and I had the funds in my account within 24 hours. Their transparency and dedication to customer service are top-notch.

David R.

Applying for a loan was so easy with Bright Financial. The entire experience was smooth, and I really appreciated how flexible their repayment plans are. I highly recommend them to anyone in need of financial help.

Emily G.

Working with Bright Financial has been such a positive experience. Their customer service team is excellent, and they guided me through every step. The quick approval was just the icing on the cake.

Jason T.

Bright Financial made the loan application process stress-free. Their support team was always available, and I got the funds in my account the next day. I would recommend them without hesitation.

Mark P.

Featured in

Frequently Asked Questions

Can I check my loan rates without impacting my credit score?

Yes, checking your loan options with Bright Financial won’t affect your credit score. We only perform a “soft inquiry” when assessing your eligibility.

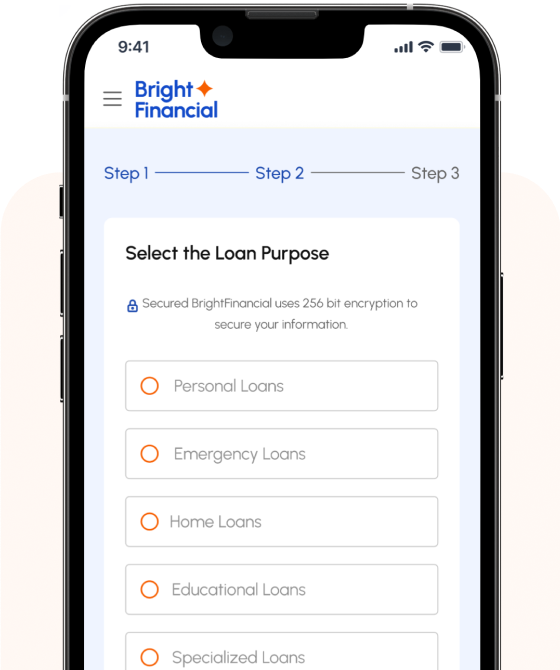

What can I use my personal loan for?

Our personal loans can be used for a variety of purposes, including debt consolidation, home improvement, medical expenses, or large purchases. We offer flexibility to meet your specific financial needs.

Is there a minimum income requirement to apply?

While there is no strict minimum income requirement, we do review your financial situation, including income, to ensure you’re able to meet repayment terms comfortably.

Can I change my payment due date?

Yes, we offer the flexibility to adjust your payment due date. Please contact our support team, and we’ll work with you to find the best solution.

What happens if I miss a payment?

If you miss a payment, we recommend contacting us as soon as possible to discuss your options. Late payments may incur additional fees and could affect your credit score.

How quickly can I receive my loan funds?

Once your loan is approved, funds are typically deposited into your account within one business day, so you can access your money quickly.

Ready to Reach Your Financial Dreams? Partner with Bright Financial Today!

Your Financial Journey, Backed by Expert Support

At Bright Financial, we do more than provide loans—we help you turn your financial goals into reality. Whether you’re looking to purchase a home, further your education, or achieve other financial milestones, we offer personalized loan options that align with your needs. Start your journey toward financial success with the confidence that comes from having a dedicated team of experts by your side, offering guidance and support at every step.