Home / Consolidation Loan

Simplify Your Debt with a Bright Financial Consolidation Loan

- Reduce Your Monthly Payments

- Combine Multiple Payments into One

- Boost Your Credit Score

*Applying won’t affect your credit score.

Why Choose Bright Financial for Consolidation Loans?

Effortless Application with Professional Support

Navigate our easy and straightforward application process with the help of our experienced team, who are ready to provide personalized guidance every step of the way.

Tailored Loan Solutions

Work with our specialists to customize loan terms that align with your consolidation goals and financial situation, ensuring the right fit for your needs.

No Prepayment Penalties

Enjoy the flexibility to pay off your consolidation loan early, without incurring any extra fees or penalties—giving you full control of your financial future.

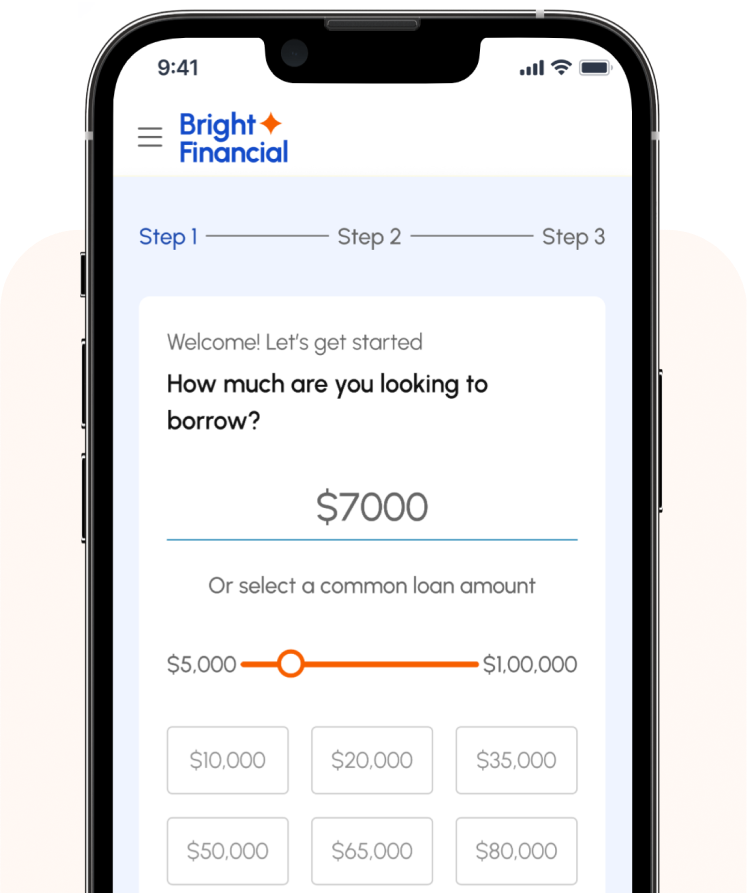

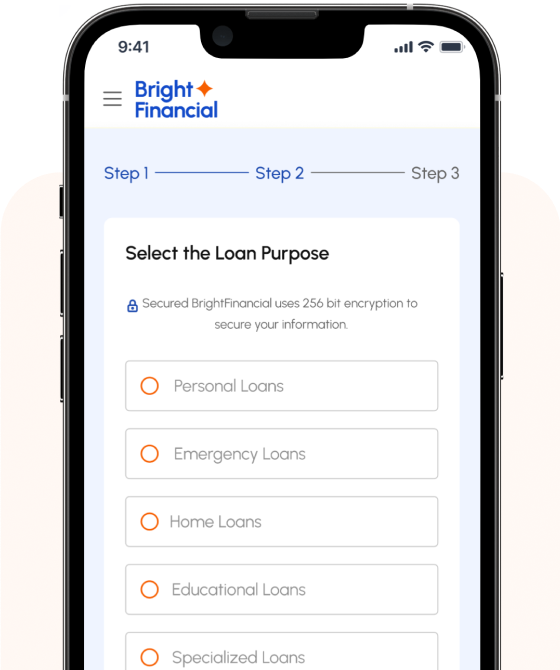

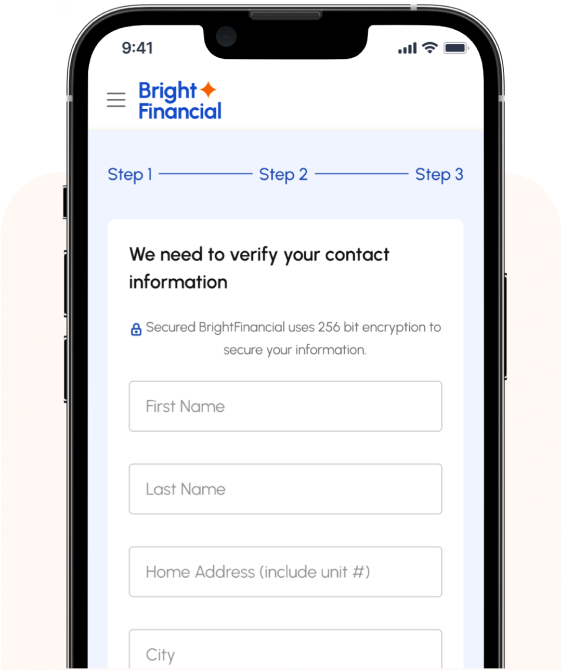

Explore Your Loan Options in Three Easy Steps

Enter Your Information

Start by filling out our simple form with the necessary details. Let us know your preferred time for a call, and we’ll schedule it to suit your availability. We prioritize your convenience to ensure a smooth experience.

Discuss Your Financial Goals

Our experienced loan consultants will work with you to understand your financial goals, explore various loan options, and find the best terms and rates for your needs. If you qualify, we’ll guide you through the application process with ease.

Receive Your Loan Decision

Once your application is submitted, you’ll receive a quick loan decision. In most cases, 99% of approved loans are disbursed within one business day. Take the final step toward financial freedom and empowerment today!

Frequently Asked Questions (Consolidation Loans)

We’ve compiled some common questions to help you get started with simplifying your finances. If you have additional questions, our team is here to assist—don’t hesitate to reach out!

What is a consolidation loan?

A consolidation loan combines multiple loans or lines of credit into one single loan, making it easier to manage and potentially lowering your monthly payments.

How do I apply for a consolidation loan with Bright Financial?

You can apply online by filling out our quick application form. Once submitted, our loan specialists will review your application and contact you to discuss your options.

Do I need a good credit score to qualify?

While having a good credit score may help you secure better rates, Bright Financial works with a variety of credit profiles. We offer flexible loan options to help meet your financial needs.

How much can I borrow with a consolidation loan?

Loan amounts vary based on your financial profile and needs but typically range from $1,000 to $50,000. We’ll work with you to find a loan amount that fits your situation.

What are the interest rates for consolidation loans?

Interest rates vary depending on factors such as your credit score, loan amount, and term. Our rates are competitive, starting as low as 6.99% APR and going up to 35.99%.

How soon can I get approved and receive the funds?

Most applications are approved within minutes, and once approved, funds are typically deposited into your account within one business day.

Will applying for a consolidation loan affect my credit score?

Checking your loan options with Bright Financial won’t affect your credit score. We perform a soft inquiry, which does not impact your credit report.

Can I repay my consolidation loan early?

Yes, you can pay off your loan early without any prepayment penalties, allowing you to save on interest and get out of debt faster.

Are there any fees associated with consolidation loans?

Bright Financial is transparent about fees during the application process. Some loans may include origination fees, but there are no hidden fees or charges.

Can a consolidation loan help improve my credit score?

Yes, consolidating your debt and making consistent, on-time payments can help improve your credit score over time by reducing your overall credit utilization and demonstrating responsible repayment habits.

Take Charge of Your Financial Future with Confidence

Choose Bright Financial for Loans that Simplify Your Financial Life

Begin your journey toward financial peace of mind with Bright Financial. Our goal is to help you streamline your finances by offering tailored loan solutions that make managing multiple payments easier. Imagine a future with fewer bills, lower interest rates, and less financial stress. Bright Financial is your trusted partner, providing expert guidance and unwavering support every step of the way.