Home / Home Improvement Loan

Transform Your Home with a Home Improvement Loan

- Flexible Loan Amounts

- Adjustable Repayment Terms

- No Collateral Required

*Applying won’t affect your credit score.

Why Choose Bright Financial for Home Improvement Loans?

Streamlined Application with Expert Guidance

Navigate a hassle-free application process with the support of our dedicated team, ensuring you feel confident every step of the way.

Tailored Loan Options for Your Needs

Work with our specialists to craft loan terms that fit your specific home improvement goals, helping you achieve the upgrades you’ve always wanted.

No Prepayment Penalties

Enjoy the freedom to repay your loan early without worrying about additional fees or charges.

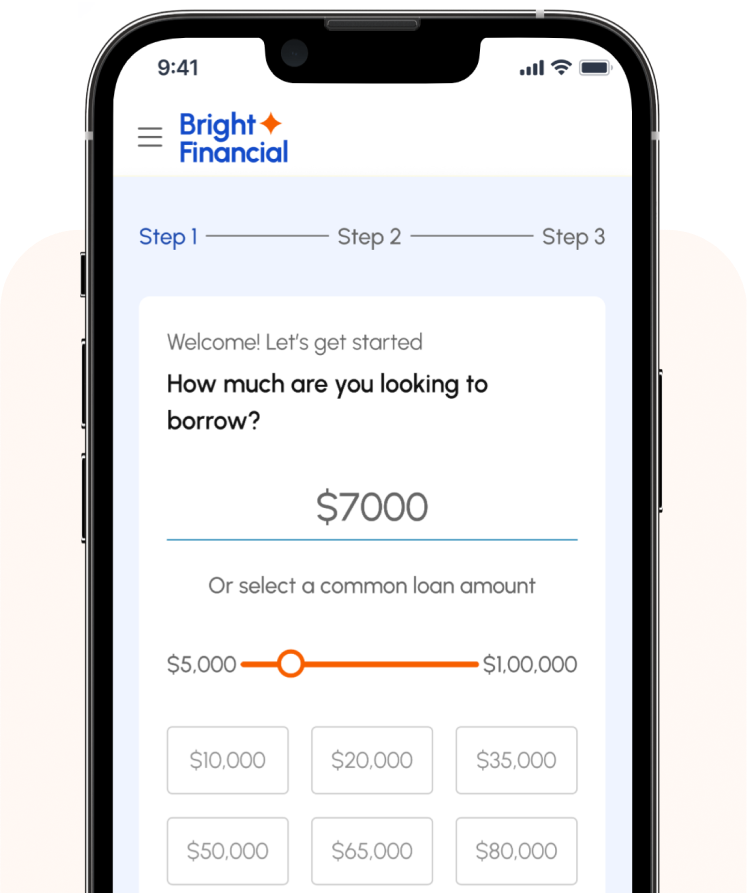

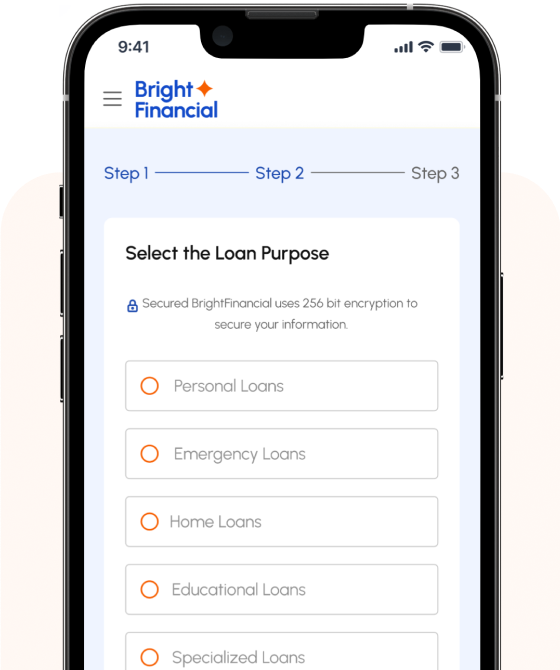

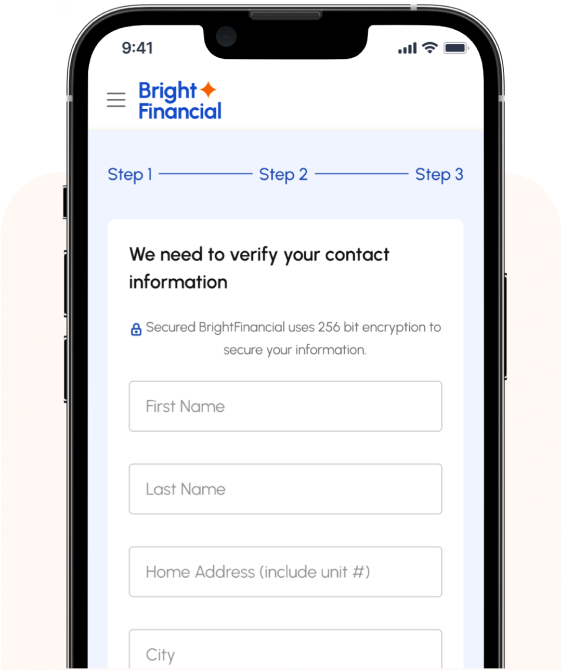

Get Your Loan in Three Simple Steps

Share Your Information

Complete our quick and easy online form with your essential details. Choose your preferred time for a call, and our team will reach out at your convenience to get started.

Discuss Your Financial Goals

Our loan consultants will work with you to explore your financial goals and the best loan options for your needs. Together, we’ll determine the right terms and rates for you, guiding you smoothly through the next steps.

Receive Fast Approval

Once your application is submitted, you can expect a rapid approval decision. In most cases, funds are deposited directly into your account within one business day. Start your journey to financial freedom now!

Frequently Asked Questions (Home Renovation Loan)

We’ve answered some of the most common questions to help you get started on your home improvement project. If you need further assistance, don’t hesitate to reach out!

What is a home improvement loan?

A home improvement loan is a type of personal loan used to finance renovations, repairs, or upgrades to your home. It allows you to borrow a fixed amount and pay it back over time with set monthly payments.

How do I apply for a home improvement loan with Bright Financial?

You can apply online by filling out our simple application form. After submitting your details, our loan specialists will guide you through the process and help you find the best loan option for your project.

Do I need a good credit score to qualify?

While having a good credit score may help you secure better rates, we work with a variety of credit profiles to offer flexible options. Don’t worry if your credit isn’t perfect—we’ll help you explore your options.

How much can I borrow for my home improvement project?

Loan amounts range from $1,000 to $50,000 depending on your financial profile and the size of your project. We’ll help determine the amount that’s right for you based on your needs and creditworthiness.

What are the interest rates for home renovation loans?

Interest rates vary based on your credit profile, loan term, and the amount borrowed. Our rates are competitive, starting as low as 6.99% APR and going up to 35.99%.

How soon can I get approved and receive the funds?

Our approval process is quick, with most applicants receiving approval within minutes. Once approved, funds are typically deposited into your account within one business day.

Is collateral required for a home improvement loan?

No, our home improvement loans are unsecured, which means you don’t need to provide collateral, such as your home, to qualify.

Can I pay off my home improvement loan early?

Yes! You can pay off your loan early without any prepayment penalties, helping you save on interest.

What can I use a home improvement loan for?

You can use a home improvement loan for any renovation or repair projects, including kitchen remodels, roof repairs, adding new rooms, landscaping, or other home upgrades.

Are there any fees associated with the loan?

We are transparent about any fees during the application process. Some loans may have origination fees, but there are no hidden charges or prepayment penalties.

Start Your Home Improvement Journey with Confidence

Choose Bright Financial for Loans that Bring Your Vision to Life

Take the first step towards transforming your home with Bright Financial. We offer personalized loan solutions tailored to your specific renovation needs, whether you’re updating your kitchen, remodeling a bathroom, or expanding your living space. Imagine a future where your ideal home is within reach. With Bright Financial by your side, you’ll receive expert guidance and steadfast support every step of the way.